In individuals, insanity is rare; but in groups, parties, nations and epochs, it is the rule.

- Friedrich Nietzsche

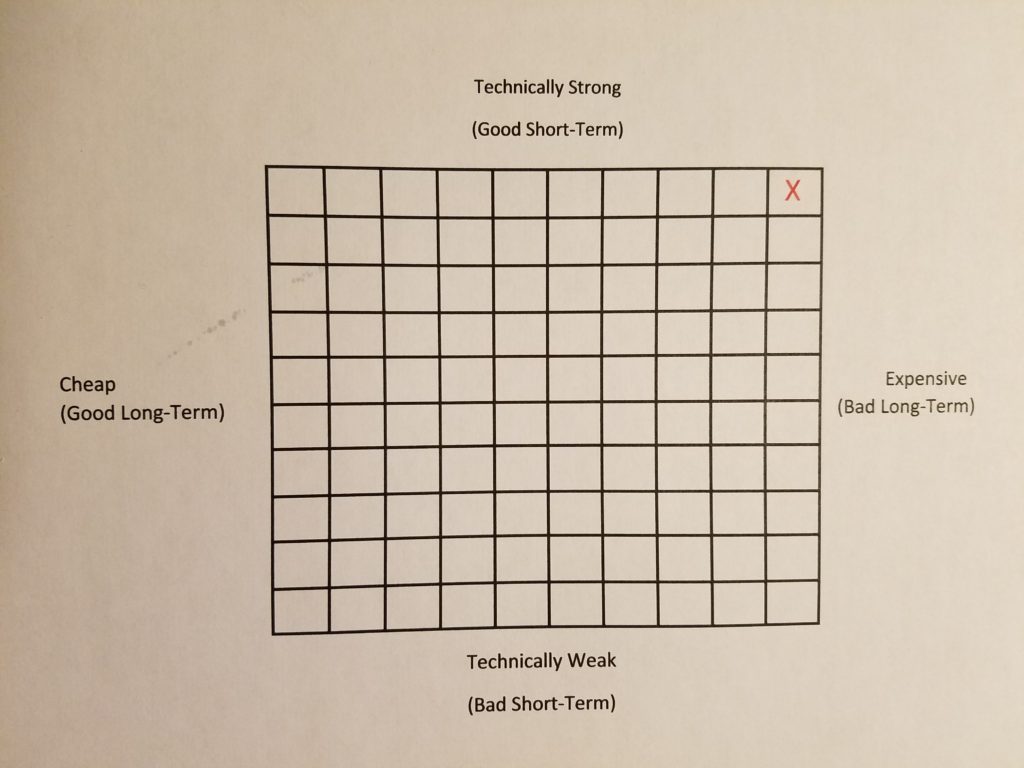

In my last blog post I laid out a fairly simple system we use to evaluate opportunity in the market and help guide our investment process for our clients. If you did not see it, I would encourage you to review it at https://planaccordingly.com/the-matrix/

Today I want to focus on where we find ourselves at this point in time within this paradigm and make a prediction as to where we might go next.

First, with respect to valuation – we find ourselves in the most expensive decile observed over time. Just to highlight some of the metrics we look at to evaluate this:

Price to Earnings Ratio: The last complete quarter for which we have reported earnings on the S&P 500 is 2Q2017, and the final calculation came in at $104.02. As I write this, approximately one-quarter of the S&P 500 companies have reported for 3Q2017 and the official estimate from S&P Dow Jones is $106.96. There is obviously a little uncertainty around what the final number will be when reporting season wraps up, but let’s agree that at present the S&P earnings are around $107 per share. As an aside, this will finally get us back to and slightly surpass the previous high in per-share earnings of $105.96 observed in 3Q2014 (3 years ago!).

Today, October 24, 2017, the S&P 500 closed at 2569.13. When you divide the index value into the earnings figure (2569.13/107), you get a price-to-earnings multiple of 24x. To put this into context, you are paying $24 for every dollar of earnings this basket of companies, weighted by market value, is generating at present. Is this a good deal?

Well, 1/24 equals an earnings yield of 4.17%. Does that sound reasonable? Maybe it does against a 10-year treasury yield of 2.4%, but historically it lands in the most expensive decile.

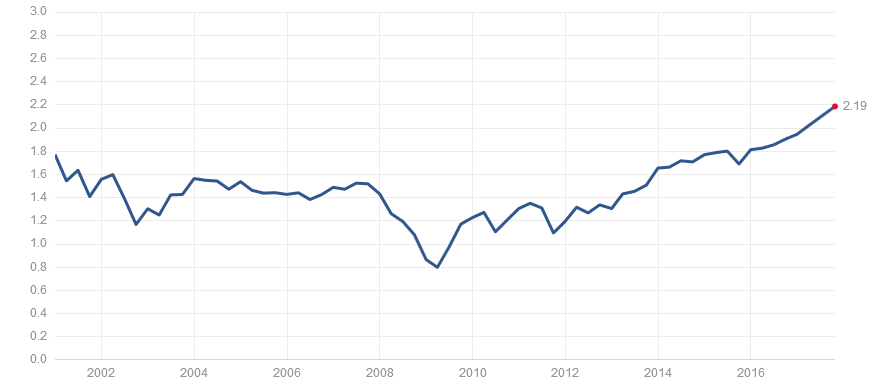

Price to Sales Ratio: These two charts speak for themselves. The first is the price-to-sales ratio for the index overall, weighted by index components (market capitalization) (Source: multpl.com):

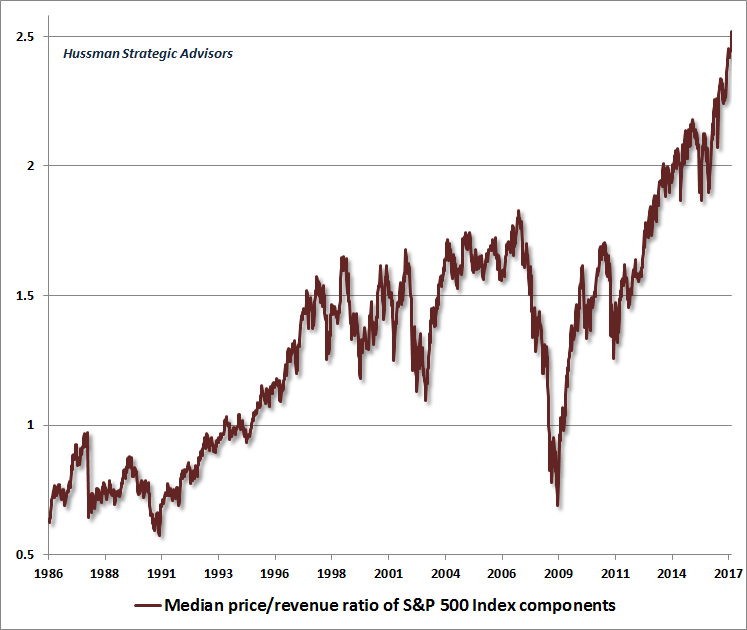

The second looks at the median price-to-sales ratio among the 500 components of the index. In other words, if we were to look at all 500 companies and rank them on this one statistic, where would we find the middle observation, where half of the companies are more expensive on this one measure of value and the other half are less?:

Gets your attention, doesn’t it?

Any time you observe a statistic such as this one at an extreme reading, in this case easily an all-time-high, you have to stand up and take notice. This is especially true given that this particular statistic has a long history of reverting back to its long-term average observation of approximately 1.5x.

So, we know that within The Matrix, we currently find ourselves in the furthest column to the right, which implies disappointing returns over the next 10-12 years for buy-and-hold investors in strategies which closely mimic the S&P 500 index.

What about the y-axis? Well, that is the good news. On all ten of our questions surveying technical strength in the S&P 500 index, the answer is “yes.” Visually, this puts us here:

So, for the time being, we are moderately aggressive in holding equities for our clients. Despite the fact that the market looks very expensive on a historical basis, virtually every segment of it appears to be firmly in an uptrend. “Party on, Garth!”

I suspect that the next destination in the Matrix will be the dreaded Southeast quadrant, where both long-term and short-term prospects will look disappointing. It seems very unlikely that we will witness enough improvement in the fundamentals (growth in both sales and profits among the S&P 500 companies) to correct the overvalued observations without having a bear market in the process. The only way this would be possible would be for the collective top and bottom lines to grow faster than the index over the next several years, without experiencing any technical weakness over the intervening period. Anything is possible, but such an outcome seems like a very remote possibility to me.

In summary, I have a lot of respect for the current strength of the market, especially given the broad-based nature of it, and fully recognize that it may continue for a while longer and extend these valuation metrics even further than one would think possible.

Keep in mind that Nietzsche quote. We remain vigilant for signs of changing trends.

All investing involves risk and you may incur a profit or a loss. There is no assurance that any investment strategy will be successful. Keep in mind that individuals cannot invest directly in any index. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of David McKee and not necessarily those of Raymond James.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. U.S. government bonds and Treasury bills are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury bills are certificates reflecting short-term (less than one year) obligations of the U.S. government.

[Please note that all archived content is for informational purposes only. Investment decisions should not be based on the content provided herein. For the most up-to-date statistical information and analysis, please contact your financial professional.]